Property Update

Disclaimer

Aus Property Professionals Pty Ltd retains the copyright in relation to all of the information contained on its website and in this report. This ‘Property Field Guide’, and any content provided in addition, or linked to resources, is general information only and not investment advice. As everyone’s individual situation is different, we advise individuals to always seek advice from relevant professionals such as legal, financial, accounting, and investing experts.

The intention of this property field guide is to be used for general information purposes only, in addition to your personal research and due diligence. We do not take any responsibility for any actions taken as a result of this guide as any actions should always be taken with consultation with relevant professionals who take individual circumstances to account.

Past performance doesn’t guarantee future results.

We have compiled the information contained in this guide from online resources, our research, and consultations, and we can not guarantee the complete accuracy of this information, and we will always reference the resources where the data and information was derived.

Foreword, Lloyd Edge

As experienced buyers’ agents, we are constantly researching and evaluating the property markets. We work for the buyer and always put people first.

Whether you are a homeowner, home seeker, investor, or just like to keep a keen eye on the market, this field guide was created to give you an insight of our knowledge of market indicators that shape the real estate landscape.

My team is dedicated to analysing market movements and the economic reactions from Government spending and Reserve Bank interest rate decisions.

The growth in housing prices since pre-pandemic (Feb 2020) until now has been approximately 34% meaning that property has proven its resilience as an investment vehicle and is now entering into the next property cycle.

My personal outlook on the 2024 property markets is very optimistic, and we should see most markets go from strength to strength, thanks to the strict Government controls and monitoring of the lending markets.

In the past recent years, there was so much confusion and misinformation which led to economic experts warning of property market crashes, and the dooms-day predictions never came to fruition. This Property Field Guide was created to assist the “every day” property enthusiast to understand the property markets.

If you have any specific questions, we are always here to assist:

1800 146 837 or admin@auspropertyprofessionals.com.au

Lloyd Edge, Director of Aus Property Professionals Pty Ltd

Best-selling author of Positively Geared and Buy Now

What drives Australian property prices?

Forecasting the movement of Australian house prices isn’t as easy as it seems, because there isn’t just one Australian property market. There also isn’t just Sydney, Melbourne, Brisbane, Adelaide, Perth, etc. In fact, there is a property market in every suburb of every region, of every city in Australia and within these suburbs there are even micro suburbs (referred to as ‘micro-burbs’) which means that certain streets in suburbs might actually perform very differently than the neighbouring streets! A good example of this could be streets that contain beach front houses which will perform differently and be more expensive then houses on the next street without the beach front. The same as for identical houses in the same suburb, the one on the quiet street is worth a lot more than the one on the noisy street.

A lot of what you hear about property prices in the media are just predictions that are fuelled by economists who are not active in the real estate industry and do not fully understand the strength and resilience in the Australian Property Markets. I say “markets” and not market, because there are many different markets around the country which will be impact by different events.

With rising interest rates, inflation, and a high cost of living, economists are (once again) predicting a property market “crash”, but this is an unlikely scenario.

Factors that drive Australian property prices?

"The drivers of property prices are based on the economics of supply and demand alongside inflation and can be broadly referred to as income, employment rates, credit availability, and borrowing capacity (which is dependent on the interest rate). Understanding these concepts will assist in predicting how the property market will react to any event, but also keeping in mind that the property market will also organically move in cycles of growth and decline (experts often refer to this organic movement as ‘the property clock’). This is why economists predictions are often wrong- there are so many moving factors to consider.

Population Growth

Australian population growth was fairly stagnant during the pandemic. Now, with the international borders open we will start to see the population growth percentage begin to rise.

Interest Rates

Interest rates effect buyers borrowing capacity but it is a double edged sword because the rising interest rates should be assisting to grow any cash savings.

Cost of Living

This impacts the affordability for buyers, and if they are currently renting, the cost of rents currently increasing so landlords can recoup their interest rate expenses which is putting pressure on the property market. Many renters are becoming increasingly frustrated and are weighing up if it might be more beneficial for them to buy a property rather than pay rising rental costs.

Building Industry

The slow-down in new buildings is inhibiting supply. When demand is greater than supply the prices will start to rises. This is being fuelled by the lack of materials, as well as the rising cost of materials is influencing more home owners to wait before they build or renovate. Many builders just can not get their hands on materials quick enough to support their builds which is impacting the market supply. This supports property prices.

International Travel

With international travel opened up to the world, there are more foreign travellers entering the country looking to live, work, or study here which is increasing population growth. Also, foreign investors are entering the Australian property market which is increasing the demand for properties.

Decline in Commodities

The fall in the global share markets, as well as the crash in Bitcoin is enticing investors to pull out of other forms of investments and to put their money into Australian property- due to the performance and resilience that Australian Property showed throughout the last two years.

Government Incentives

The State Governments have introduced new incentives to help first time home buyers enter the property market. Buyers that previously were unable to borrow enough, or save enough deposit are now entering the market. This has increased the demand for property, especially in the lower price points.

Media

Unfortunately, media still has a tight grip on the supply and demand for properties. When there are reports of a looming property market crash (no matter how unfounded it is), then we will see many buyers be scared and leave the market. Same goes for when there are reports of a property boom, buyers who are on the sideline will suddenly be pursuaded to enter into the market.

Interest Rates

What’s the importance?

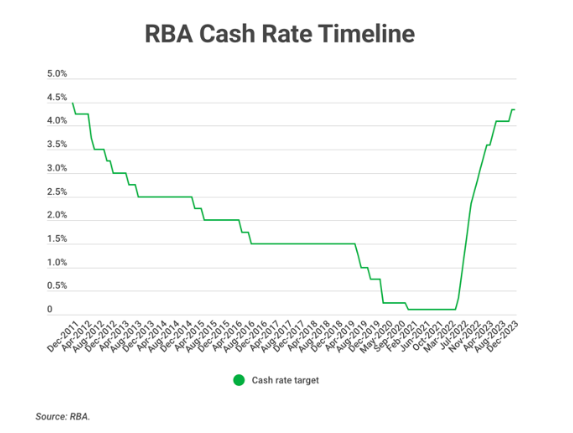

Just like property prices run in cycles, so do cash rates.

Not all markets are equal. Each property market is likely to respond differently to rising interest rates, which is what we are currently seeing particularly in Perth.

When interest rates rise, many borrowers can no longer borrow as much as they might have been able to previously, meaning they will start to look at purchasing properties at a cheaper price point. As a result, this will put further pressure and demand on the cheaper properties in the market (which isn’t helping the demand from first home buyers either). The properties that will be most impacted by this are the properties at the higher end of the market as buyers all shift to cheaper properties, and buyers hold the upper hand in negotiations.

For investors, interest rates will impact cash flow and yield on their investment properties.

When rates rise, we see many investors shift to properties in regional centres, smaller coastal towns, or outer suburbs where they can invest mainly for cash flow benefits at the sacrifice of long-term capital growth to supplement the rising interest rates on their mortgages.

Last year, 2023:

Even with the five interest rate hikes in 2023 we still experienced growth in some property markets and we saw that the rate of growth was strongly dependent on the area and property type. Although some areas were reported to be sluggish during the year, what we saw is that in some areas where we have recently experienced double-digit growth, this has slowed to single digit growth.

The 2023 year started with a Cash Rate Target of 3.10 and closed at Cash Rate Target of 4.35 after 5 rises of 0.25 points. (source: rba.gov.au)

The Big Four Bank predictions for 2024:

In February 2024, the big 4 banks changed their predictions on how interest will move during the year. The consensus is that they do not expect any rate rises in 2024 and will settle at the current cash rate of 4.25%.

Commonwealth Bank

A September rate cut, with rates coming down to 2.85% by May 2025.

Westpac

In agreeance with CommBank for a September 2024 rate cut but are guessing we will need to wait until December 2025 before we see rates down to 2.85%.

NAB

A December rate cut, with rates to remain around 4% for this year but will be as low as 3.6% in June 2025.

ANZ

Rates will remain higher with a 3.6% cash rate by June 2025.

All Big 4 Banks predict that interest rates have reached their peak, and there are only rate cuts to be seen in 2024.

Interest Rates - Lloyd’s Predictions

Lloyd Edge is keeping a close eye on the Reserve Bank, the economy, and how it is impacting our property markets. He puts it straight to mortgage holders, that they must understand this period of rising interest rates was also the expectation of the banks. We all knew that historically low interest rates (record low of 0.1%) were not going to last forever, and when banks were offering and approving loans this was on the foresight that interest rates would increase over the term of the loan- everyone knew that rates weren’t going to stay low forever.

For the first half of 2024, interest rates are likely to stabilise the economy and considering the reserve bank has got relative control of inflation, bringing it close to 4%, we do not expect any more rate rises.

Going against the Big 4 Banks, Lloyd said he wouldn’t be surprised if there was a major rate cut much sooner this year, around June 2024.

The RBA’s decisions will have a greater impact on the wider economy and inflation during this year because a lot of mortgage holders have come off their fixed rates and onto high variable rates. One thing is for sure, property has shown it’s resilience and the interest rate rises have not deterred first home buyers and investors. The rate rises have mostly impacted their serviceability and made them re-think their budget. Now that the Reserve Bank has a grip on inflation, we will be seeing even more investors entering the market as they gain confidence in their investment decisions, and we should see this reflected in house price increases in the favoured areas.

2024 Crash?

According to ANZ’s most recent housing report, capital city property prices are set to climb by a modest 5% in late 2024. This is much higher than what the Reserve Bank of Australia is predicting, which is a national house price drop of 11% by the end of 2024. But you need to take this advice with a grain of salt. The “experts” at Commonwealth Bank predicted 20% plus price falls in the Australian Property Market during the pandemic, however we actually experienced price increases in many markets across the country.

In order for property prices to crash, we would need to see a storm of the following:

- Rising interest rates alongside;

- Rising unemployment alongside;

- Rising cost of living alongside;

- A downturn in the economy alongside;

- A drop in housing demand.

One thing that is keeping our property market strong is the unemployment rate.

Currently, the Australian unemployment rate is at 4.1% which is one of the lowest ever since the mid-1970s. There is actually a shortage of workers available in many industries at the moment. A safe level of unemployment is considered around 4.5%-5% and we would begin to worry if unemployment started rising above this to around 6% or more. For a crash to occur we would see unemployment above 6% or closer to the 7% mark.

Currently, there is such a strong demand for housing that builders are unable to keep up. The rising cost of materials and lack of available land in popular areas means that there just isn’t enough housing being built to keep up with demand, so much so that this has led to a housing shortage crisis across the country.

How to protect your property.

How to protect your property from declining in value.

If you are worried about a fall in the property market, the best way to protect your investment property is by manufacturing equity in your property so that it doesn’t matter how the market is performing, you are still able to make some gains on your property.

To manufacture equity in your property this can be done through renovation, basic upgrades, landscaping, or subdividing the land. Basically, anything that will create more value for your investment property is how you can manufacture equity in your investment, so you no longer need to rely on the growth of the market.

We expect interest rates to stabilise and rate cuts from mid to late 2024, which will result with more faith in the property investing markets, putting upward pressure on property prices.

The majority of households who had fixed their mortgage rates at ultra low interest rates have come off their fixed terms and are likely to be on a higher variable interest rate. We expect households to restrict their spending on discretionary spending and luxury goods, but there is still plenty of property investors looking to expand their property portfolios.

The Western Australian market had the best performance in 2023, and we expect many investors to flock to this market in 2024, but have they missed the boat? The true test is the long term performance of this market. Most of the growth over a 10 year period will happen in a 2-3 year period which is what we are seeing in W.A. now. Investors need to take caution and look further from the short-term to see what we predict this market to look like in 10 years from now.

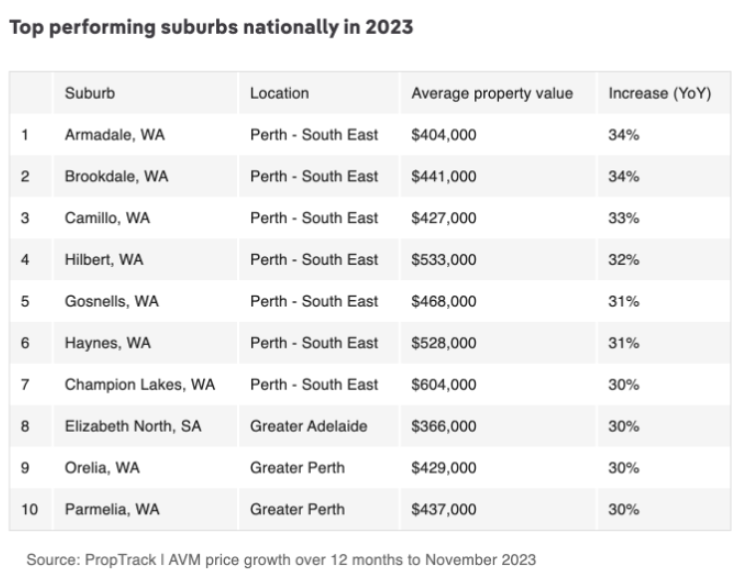

2023 Top Performers

For 2023, the top performing suburbs were all based in W.A. and we have seen this grow in popularity for both migrants buying a primary residence, and investors.

Where to buy 2024

Thinking “outside the square” and trying to go “against the grain” we have researched these area’s to discover they might be pipped for growth during 2024. Once you start hearing intensely about a market to invest into, its likely already too late to jump on board.

Earlwood, NSW.

Median House Price: $1,850,000

12 month growth: 6.19%

2 years price growth: 12.5%

10 year average annual growth rate: 6.86%

Average rental yield: 2.59%

Population: around 17 000+ in the suburb

Vacancy rate 0.65%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

Located 10km south west from the CBD is Earlwood. The biggest drawcard here is the relative affordability in comparison to its proximity to everything.

Earlwood is a more family orientated suburb where growing young families are deciding to trade in their inner city apartments to buy a house in Earlwood.

The median price in Earlwood is $1.85million which may still seem quite unaffordable for some, but when looking to its neighbours of Dulwich Hill which has a median house price of $2million and Summer Hill which has seen recent growth bring its median house price to over $2.2million, then you will be able to get a little more bang for your buck in Earlwood.

For investors, Earlwood is a bridesmaid suburb that we are expecting to see long term growth as families are priced out of the trendy Summer Hill and Marrickville. Earlwood has all the brick house charm and inner city living vibe with some gentrification occurring in this suburb.

Belmont South, NSW.

Median House Price: $740 000

12 month growth: N/A

2 years price growth: 23%

10 year average annual growth rate: 6.90%

Average rental yield: 3.55%

Population: around 197 000 in the Lake Macquarie region

Vacancy rate 1.12%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Belmont South:

If you are looking for a quieter lifestyle then Belmont South, located 30mins south from Newcastle CBD, might be an excellent choice for you. Boasting a golf course, nine-mile beach, blacksmiths beach, and holiday park it is known to be a relaxed tourist destination.

The median house price in Belmont South is $740,000 with steady average annual growth of 6.9%. This bridesmaid suburb is a much cheaper choice than it’s “bride” of Belmont that has a median price just shy of $1million at $995 000. It is also a much more affordable choice than its neighbour Swansea with a median price at $900 000.

Beresfield, NSW.

Median House Price: $599 975

12 month growth: 1.61%

2 years price growth: 15.28%

10 year average annual growth rate: 8.72%

Average rental yield: 4.8%

Population: around 155 000 in the Newcastle region

Vacancy rate 0.49%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Beresfield:

If you really want to get onto the ladder of home ownership but are feeling priced out of the inner circle of Newcastle, the Beresfield might be a suitable option. The median house price is $599 500 and the average annual growth rate is 8.72%. There are some sacrifices to living in this more affordable area as it is 35 to 45 minutes’ drive into the Newcastle CBD, but there is a train line to help with the peak hour travel. You will find most conveniences you need in Beresfield, like cafes, takeaway food and supermarkets as well as public school and soccer fields. You may feel a little further out from the action of Newcastle, however a lot of people prefer this quieter leafy suburb knowing that the Newcastle CBD is still very accessible.

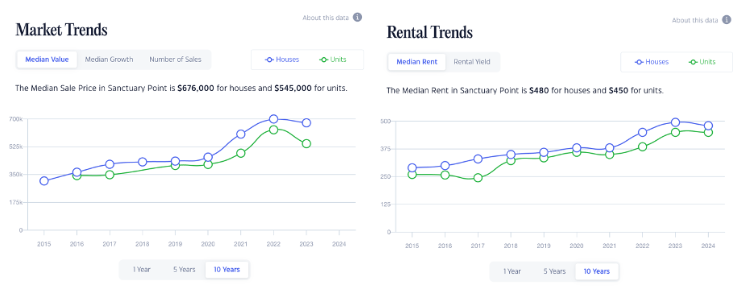

Sanctuary Point, NSW.

Median House Price: $676 000

12 month growth: 0%

2 years price growth: 16.7%

10 year average annual growth rate: 9.47%

Average rental yield: 3.85%

Population: around 99 654 in the Shoalhaven region

Vacancy rate 0.74%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Sanctuary Point:

Drive an hour and a half south of Wollongong and you will arrive at the beautiful suburb known as Sanctuary Point. This area has wildlife, national parks, pristine beaches, and family lifestyle in abundance.

The median house price is a great entry point for families, sitting at $676,000.

The main town centre of Nowra is only 30minutes away where you can find anything and everything you need.

This median price is a real steal for this coastal lifestyle, especially compared to 10minutes east where Hyams Beach attracts both eyewatering prices of $2million plus along with an eyewatering amount of tourists, due to its famous beach with the whitest sand in the world.

Heidelberg, VIC

Median House Price: $1,480,000

12 month growth: 4.96%

10 year average annual growth rate: 6.7%

Average rental yield: 2.29%

Population: 121 000+ in the region, 6 000+ in the suburb

Vacancy rate 1.44%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Heidelberg, Vic:

Ideal if you are looking for a home, and your dream is to live amongst the historic buildings in the tranquil, oak-lined streets of Ivanhoe, VIC. Ivanhoe has a median house price of $1.62million. Ivanhoe lies just 12km from the Melbourne CBD and is known to be an elitist and exclusive suburb due to the affluent families that reside here for the prestigious private schools.

If you want to feel like an Ivanhoe local but don’t have the budget, look 3km up the road to Heidelberg, where you will have access to similar conveniences. Heidelberg is a more affordable suburb with plenty of shops and eateries, and the median house prices are a cool $1.25million. For investors, this suburb is likely to grow even more in popularity as buyers get priced out of Ivanhoe and look to the “next best thing” in Heidelberg.

Next door, Heidelberg heights is also quite a desirable suburb with median house price under $1million sitting at $939,500. But be cautious. Moving further to Heidelberg West may have an attractive median house price under $700,000 but it is not the same as Heidelberg or Heidelberg heights. Heidelberg West has a cheaper price point however there is a high crime rate statistic here, which is why families choose to pay more to live in the neighbouring suburbs.

Diamond Creek, VIC

Median House Price: $925,000

12 month growth: -2.64%

2 year price change: 3.93%

10 year average annual growth rate: 4.9%

Average rental yield: 3.32%

Population: 61 000+ in the region, 11 000+ in the suburb

Vacancy rate 0.33%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Diamond Creek:

Looking north from Melbourne, Diamond Creek is the bridesmaid suburb to the beautiful suburb of Research, which lies on the doorstep to the Yarra Valley. This area is popular because it offers families large leafy block sizes alongside excellent schools and daycare centres. By comparison to Diamond Creek’s median house price of $925 000, Research has a median house price of $1.69million, not the average family can afford this tranquil lifestyle.

Just 6km north-west of Research is Diamond Creek, which offers a similar lifestyle but at a more affordable price point with some change from $1million. The CBD is still accessible being a 45minute trip. Diamond Creek is such a great place for families to live, in fact it topped the Lendi “best suburbs to raise a family list in Melbourne” beating the rivals of Doncaster East, Sandringham and Newport because of it’s very low crime rate, the number of schools and playgrounds and great outdoor spaces for families to enjoy.

Investors can keep a keen eye on this one, as prices will be pushed up as families want to move in for the lifestyle. Investors will reap benefits when buying property in areas where families want to live, as owner occupiers are likely to pay a premium for properties.

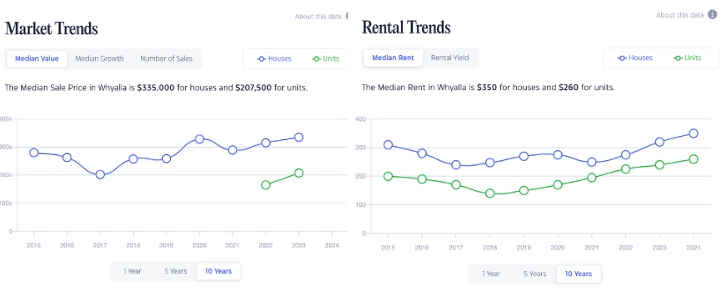

Whyalla S.A.

Median House Price: $360 000

12 month growth: 11.62%

2 years price growth: 16.12%

10 year average annual growth rate: 5.4%

Average rental yield: 7.38%

Population: around 21 000+ in the region

Vacancy rate 0.67%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Whyalla:

Whyalla has a very affordable median house price point for first time investors who want to get a foothold on the investment ladder, with plenty of properties available under $400 000.

Whyalla, S.A. is showing potential for investors due to its high output of Gross Regional Product, around $1.16billion annually, and it’s Regional Economic Output is about $2.4billion.

Whyalla brings in around $42million alone from Tourism due to the popularity of water sports, adventure options, snorkelling and diving, fishing, and steelworks.

There is opportunity in Whyalla for good cashflow, with yields very high at 7.38% even in the current economic climate, there is opportunity for a positively geared investment property.

Whyalla has employment opportunities in defence force, energy and mining (including solar and wind farms).

Whyalla also has its own airport for FIFO workers (Fly In, Fly Out) as well as a large Port, the Port of Whyalla.

Whyalla is also home to the South Australian Space Industry Centre.

Tourism is popular for water sports in particular along the Eyre Peninsula.

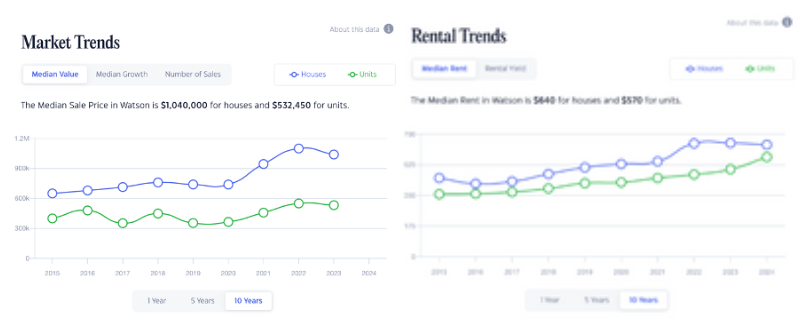

Watson, ACT

Median House Price: $1 040 000

12 month growth: -5.4%

10 year average annual growth rate: 6.47%

Average rental yield: 3.22%

Population: around 396 000+ in the Canberra region

Vacancy rate 1.48%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Watson:

Buyers who are looking to live north of Canberra are enjoying the amenities that Watson has to offer especially when they have been priced out of O’Connor, which is just 10minutes southwest. Watson lies just 5km from the CBD so it is a nice choice for city workers as it is still surrounded by greenery with Watson Woodlands and Mount Majura nature reserve. It is popular for families as it has lots of local shops, café, restaurants, and a good primary school. Watson’s median house price is $1,040,000 and has seen 6.47% average annual growth whilst compared to O’Connor where the median house price is over $400,000 more at $1,410,000 with an average annual growth of 6.47%. Perhaps due to the continued rising popularity of Watson, we may see it soon come to meet O’Connor in terms of median house prices.

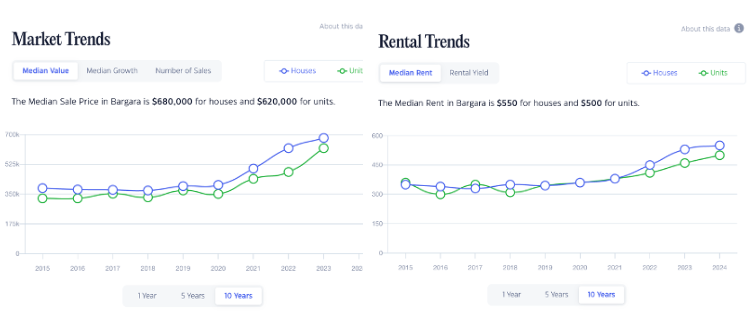

Bargara, QLD

Median House Price: $680 000

12 month growth: 9.68%

2 year growth: 47.99%

10 year average annual growth rate: 12.87%

Average rental yield: 4.3%

Population: around 92 000+ in the region

Vacancy rate 0.66%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Bargara:

Bargara lies on the coast, just 12km East (15minutes drive) from Bundaberg, which is the largest regional centre outside of South East Queensland.

The Bundaberg economy, and job opportunities means that residents looking for a more coastal lifestyle can locate in Bargara which has all the amenities, restaurants, parks, beaches and café’s that families seek.

With continued economic investment and an increasingly remote workforce, many of the buyers previously restrained to QLDs metro areas are now exploring opportunities in Bundaberg and surrounding areas, including Bargara.

Bargara thrives on tourism due to its coastal location, but its proximity to Bundaberg as its main town just 15 minutes down the road means that Bargara is quickly gaining in popularity for residents looking for an excellent lifestyle.

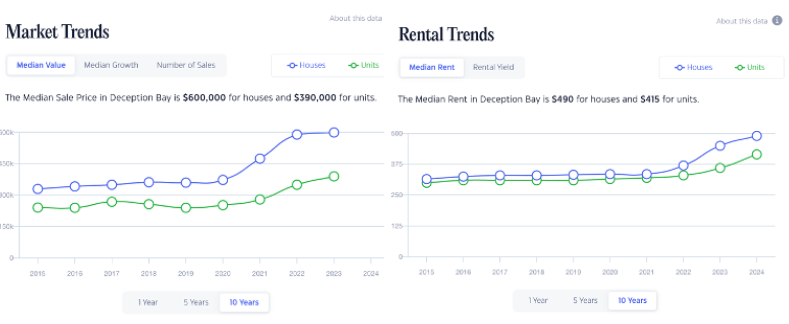

Deception Bay, QLD

Median House Price: $600 000

12 month growth: 1.69%

2 year growth: 25.57%

10 year average annual growth rate: 10.63%

Average rental yield: 4.65%

Population: around 425 000+ in the region

Vacancy rate 0.94%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Deception Bay:

Deception Bay lies just 32 kilometres north of Brisbane, located on the coast in the Moreton Bay Region (now known as the City of Moreton Bay). Deception Bay is a popular recreation spot for boating and fishing and offers plenty of lifestyle options and Moreton Bay has over 294 coastlines and waterways making it a beautiful location to live.

Deception Bay is growing in popularity which is why it is one of our top choices for investment. It is also in an affordable price bracket for investment and has a below 1% rental vacancy rate.

The population is nearing 500 000, and Moreton Bay is the 3rd largest local Government area in Australia, by population.

Moreton Bay is now ranked the 5th fastest growing region in Australia.

The City of Moreton Bay has a Regional Economic Development Strategy 2020- 2041 outlining the blueprint to build a $40 billion economy with 100 000 new jobs in the area by 2041. This is double to current Gross Regional Product of $19.9 billion.

Armadale, W.A.

Median House Price: $370 000

12 month growth: 20.96%

2 year growth: 31.57%

10 year average annual growth rate: 9.5%

Average rental yield: 6.7%

Population: around 79 000+ in the region

Vacancy rate 1.26%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Armadale:

Armadale is located 30km south east from Perth’s CBD so is accessible for city workers who don’t want to live amongst the hustle and bustle.

The Western Australian Government has plans to invest in Armadale’s infrastructure, including upgrades to the train station and improving the road networks which should increase the liveability and the property values in Armadale.

Being able to buy an investment property sub $400 000 in a market with good growth potential and rental yields makes Armdale an excellent choice for investment

Armadale offers a great lifestyle with parks, recreation facilities, and natural attractions alongside schools, medical centres, shopping centres.

There are many options for dining with many restaurants, cafes and bars.

But be careful with this one- with all the hype around W.A. some suburbs have increased due to an influx of investors activity so make sure you aren’t getting in at the top of the market.

Orelia, W.A.

Median House Price: $400 000

12 month growth: 21.21%

2 year growth: 35.51%

10 year average annual growth rate: 8.83%

Average rental yield: 6.54%

Population: around 38 000+ in the region

Vacancy rate 1.19%

*This information was accurate at time of publication. Source: CoreLogic. Keep in mind these figures will change over time. The sources of our information come from real estate figures publicised in Real Estate publication that source the information from CoreLogic. This is general information only, please seek your own advice before making any investment decisions.

What we like about Orelia:

In 2023, Orelia was featured as one of the cheapest areas in in Smart Property Investment Magazine’s Fast 50 report because it has a showcase of potential for investors.

The price point is excellent for investors looking around the $400k mark and receiving capital gains around the 15% mark. The performance of Orelia is due to it lying in one of Perth’s most affordable housing sectors- Kwinana.

Although Orelia has affordable housing, it is located just 35km from Perth CBD and only 10km from Rockingham, where the median house price is $510 000 due to the popularity of the Rockingham foreshore for its newly renovated food and lifestyle precinct with a wide range of cafes, restaurants, bars. When buyers get priced out of Rockingham, they will spread to bridesmaid suburbs like Orelia.

HOT ON THE LIPS

Perth, Western Australia. Is it too hot?

Investing in Western Australia has become hot on the lips of many property spruikers for 2024. As soon as the capital growth was showing excellent returns in 2023, investors started flocking to the Western state to invest their money hoping to reap some returns.

All of the national top 10 performing suburbs in 2023 were in Western Australia, which must be saying something, right? But there are a few important things to factor in if you plan to invest in WA in 2024.

There is some risk to investing where everyone else does which is what we have seen previously in mining towns. The market increases because there is demand for property, but if the demand is coming from investors and not from locals then the long term prospects might be risky. If the market takes a turn and investors pull out of the market, you need the residents to want to buy and live there for your property to not plummet. If the locals aren’t buying there, you should consider if it will be a viable long term investment.

Once an area becomes a hot topic, investors flock but likely they are already too late and they have missed the main growth stages of the area. You want to be buying before it becomes “the next big thing” and get into the market before everyone else. You need to keep a cool head. What we are seeing now in Perth, is a bit of a buying frenzy, and there is risk that you end up paying too much for your investment as bidders start to pay above the market value of a property. Because property values have shot up by more than 30% in some Perth suburbs, you need to take caution that you don’t overcapitalise.

The reason prices have shot up, is due to tight supply battling with high demand from both home buyers and investors.

Another reason for the growth can be contributed to migration, W.A. saw 3.1% growth rate which is the fastest of all the States but the question is whether this trend will continue. We expect Perth to hit its peak during in 2024 and urge investors to do plenty of due diligence and understand where they are buying into before they make an investment commitment.

Townsville, Is it the next big thing?

Many property advisors are suggesting Townsville might be the next big spot to put your money and looking at the figures alone like its strong rental demands and the investment in infrastructure. It might seem like it has potential, but there are many reasons why we are avoiding Townsville as a long term investment option:

Weather

The tropical climate in Townsville and even the local Government warns resident’s that the natural disaster events that might hit Townsville include Cyclone, Storm Tide, King Tide, Flood, Bushfire, Tsunami, Earth quake, Landslide. Severe tropical cyclones which are extremely destructive and life threatening are expected to hit Townsville once every 20 years (source: Bom.gov.au).

January 2024, Cyclone Kirrily (category 3) hit just north of Townville with winds up to 170km/h with over 300 000 homes without power for days. In 2011, Cyclone Yasi hit Townsville as a category 5 Cyclone, which was a frightening reminder of Cyclone Althea, category 4 which struck in 1971. The region gets monsoonal rain causing flooding, one of the worst episodes was seen in 2019 and was one of the worst natural disasters to ever impact the region. Due to this, Townsville is a high risk area for investment in our opinion. There has been a high investment in infrastructure investment in Townsville, which is what some investors are spruiking is a good reason to invest- however, investment in infrastructure is a necessity after a lot of Townsville was damaged by the severe 2019 floods as well as frequent storms and recent cyclone.

Flood Zone

Following on from the weather in Townsville, nearly all of the town is flagged as a flood zone which we typically avoid for investment purposes. Buying in a flood zone not only puts your investment at risk, but the annual costs might be more for insurance and flood mitigation.

Crime

Townsville has a disproportionately high crime rate compared to other locations. As an example, a safety index level rating of 38.27 would be considered “safe” on the crime index, and Townsville ranks 61.73. There is a high level of people using and dealing drugs, property crimes like theft and vandalism, stolen cars and items being stolen from cars, and home break ins. There is moderate levels of crime for being mugged or robbed, being attacked or assaulted as well as discriminatory attacks. Due to these findings, Townsville may present as a more risky place to invest compared with other locations.