Our Client's Story

Michael & Liz* had worked hard over the years to save enough of a deposit to get their foot in the door of property investing but had no idea on where to actually start. They wanted to set themselves up financially so they could spend more time with their kids, and not have to worry about their business all day and night.

They loved the idea of building a duplex after reading all of our client's success stories, but unfortunately didn't have enough of a deposit to do this (yet). Not knowing what strategy would help them achieve their goals, they reached out to Aus Property Professionals for guidance.

The Strategy

We sat down with Michael & Liz to explore all of their options in order to determine the best strategy moving forward. We looked at their current financial position, where they would like to be in 5, 10 & 15 years time, and set a road map on how they can actually achieve that.

Taking in to account all of the above, we determined that buying a house on a large block of land with subdivision potential was going to provide the best returns for them. Working with a budget of <$350k meant that we had to look in to regional towns, where there was still good potential for growth as well as the opportunity to manufacture instant equity.

We wanted to be able to keep the original house on the block and rent it out while the subdivision process took place, with the potential to build a duplex on the new lot when Michael & Liz had the funds available to do so. This meant that they would be earning an income on their investment from day 1, while also having the ability to manufacture equity.

Challenges

With large blocks of land becoming more scarce in top performing regional towns, we had to dig deep to find the right property. Construction and subdivision requirements also vary from council to council, so we had to ensure any property we found would meet local council's regulations for a subdivision.

More importantly, we needed to ensure it would be permitted to build a duplex on the new lot. As usual, we spoke with council, town planners, draftsmen and builders to ensure this could be done.

Acquisition

We narrowed down our search area to an excellent performing town in NSW, where we have had great success over the years with other clients.

After shortlisting and inspecting a number of properties, we found a stand-out house that ticked all the boxes. A solid 3 bedroom brick veneer home on a 1,618sqm block of land. It was well within budget, located close to all amenities and had the layout we needed to do a subdivision.

With an asking price of $335k which already represented good value, we still wanted to get this property for much less. We were able to negotiate $35k off the asking price and secure the property for $300k. With tenants already living in the property paying $330pw and happy to stay on, meant that they would be paying off Michael & Liz's mortgage.

The Results

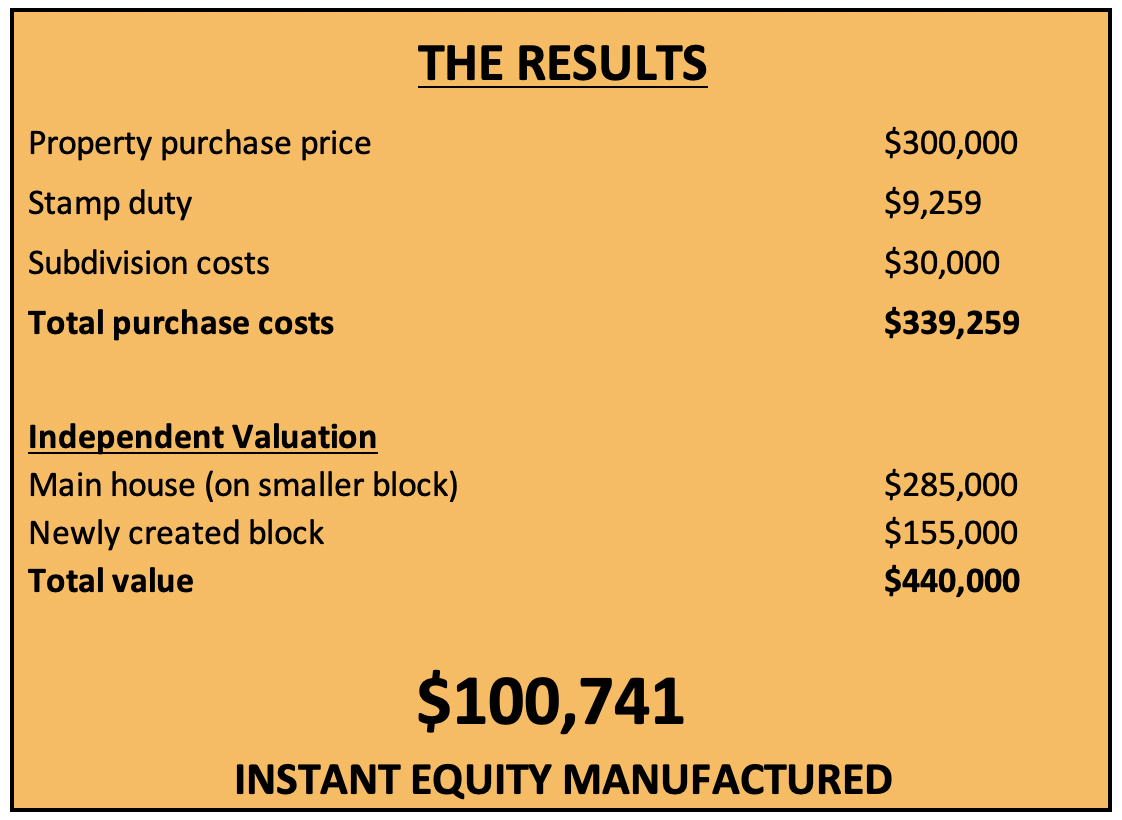

After settling on the property, Michael & Liz decided to pursue the strategy of subdividing the property in order to manufacture instant equity, giving them more options on what to do next. With our assistance and a local surveyor who we've dealt with many times, the subdivision process went smoothly getting all approved.

With the subdivision now complete, it was time to ask the bank to re-value and find out what the two individual properties were now worth; the original house plus the new vacant lot.