The 2025 real estate markets have kicked off with buyers having the upper hand, which has resulted in many renters weighing up the financial benefits of buying and considering whether it is now cheaper than renting. With the recent interest rate drop, and another one not off the cards, it is becoming more attractive to borrow money, whilst the cost of renting we have seen skyrocket over the past 2 years.

Why is it cheaper to buy than rent?

The wage price index (WPI) measures the changes in wages and salaries in the Australian labour market.

We have seen the WPI rise by 0.7% in the December 2024 quarter giving a 2024 annual increase in wages prices of 3.2%. However, this is not keeping pace with the increase in rental price growth which saw an 11.1% increase. This means that the rental market is increasing faster than wage price growth and it soon becomes unaffordable. This discrepancy between wages growth and rental growth and the decline in interest rates makes it even more attractive to borrow and buy a property as when we see interest rates decline, the loan repayments will also decline. We are not seeing this same correlation between interest rate decline to rental prices decline and the expected interest rate cuts in 2025 may improve affordability to buy property.

Of course, the decision whether it’s cheaper to buy or rent is going to differ from person to person because it will rely on multiple factors such as how much deposit you have saved, what your loan repayments will be, as well as property holding costs.

Where is it cheaper to buy than rent?

When considering if it is cheaper to buy than rent, we are considering house prices compared to the rental costs.

There are several locations across Australia where it is cheaper to buy a property than rent. According to ‘PropTrack Market Insight’ report, about 36% of Australian homes are currently more affordable to purchase than to rent, with Queensland, Western Australia, and Tasmania offering the most opportunities for buyers.

Typically, the expense of the capital cities means that buying is very expensive, but if you look to the outer suburbs (middle-ring and outer-ring suburbs) we are likely to see the benefits of buying over renting.

Many regional towns will also afford more to buying than renting. Consider areas where an investment property is likely to be positively geared, whereas in the heart of the capital cities your investment would likely be negatively geared (meaning it costs you more to own than to rent).

New South Wales

In Sydney’s CBD, Ultimo is favoured by students as it is close to both University of Technology Sydney, and the University of Sydney. The median rent for a unit is $750/week, with the average cost to buy around $690,000.

Mascot, only 5km out of the CBD is another spot where you may consider buying if you’re a renter. The median rent for a unit is $970/week but the median cost to buy is $780,000. But the same does not play true for houses, for houses you’d want to keep renting! It plays the opposite fact if you want a house with the rental market for houses paying around $950/week to rent but the to buy you are forking out around $1.9million.

Queensland.

Close to Brisbane, places like Newstead may be cheaper to buy than to rent. The median weekly rent is $750/week for a unit, but the median cost to purchase is $685,000 and for houses it is $865,000.

Mining towns like Moranbah, with the cost of rents being up around $750/week for units and $700/week for houses, it is much cheaper to buy a unit for the median price of $330,000 and $361,000 for a house. There is a lot of risk though when buying in a mining town. When it comes time to sell, you may find this difficult with not many buyers, but there is a lot of demand in the rental market.

Victoria.

If you’re renting a unit in Carlton, Vic you are likely paying around $550/week rent but you may be better off buying with median prices for units around $407,000.

Another top spot to buy rather than rent is Notting Hill which sets you back $550/week to rent a unit but an affordable median purchase price of $342,500. Houses are a lot more expensive in this area though with the median purchase price more than $1,110,000 with rents only around the $580/week mark.

Western Australia.

If you’re renting a unit in Fremantle, there may be opportunity to buy instead. The median rental cost for a unit is $720/week compared to the average purchase price for a unit of $580,000. This is a great opportunity given that Fremantle is a large town, second to Perth.

Mandogalup, south of Perth and Fremantle may not have the long-term capital growth (and negative growth in the past 12 months) however, rents are in high demand meaning they have skyrocketed to around $720/week for a house, but the median price of houses is an affordable $349,000. There is a large risk that when it comes time to sell you will find this extremely difficult but in terms of rent vs buy, you will be saving more than a “pretty penny” to buy and pay a mortgage than your high weekly rental costs. Why is this the case? Because no one particularly wants to buy property here, the demand for houses is very low but a lot of workers here are FIFO (fly In, Fly Out) workers so the demand to rent is extremely competitive. Most likely, it will be large corporations paying these high rental costs for their workers. We would not recommend this for an investment choice given the high risk and the lack of industry.

South Australia.

When renting a house in Davoren Park, you may be surprised that you could be buying the property for cheaper than your rent. The median rent for a house is around the $500/week mark and the median price of houses in this area is $480,000. There has also been some excellent growth here with the 10-year average annual growth rate sitting at 23%.

What to look for?

Lower property prices: Look for areas that have relatively low purchase prices, making mortgage repayments cheaper than rising rental costs.

Strong rent growth: Locations that have high rental demand, particularly in capital cities where rent prices have surged, homeownership might be more attractive than renting.

Unit market opportunities: In many capital cities, unit prices remain lower than rent, making them a better option for buyersTop of Form.

Current challenges for the rental market

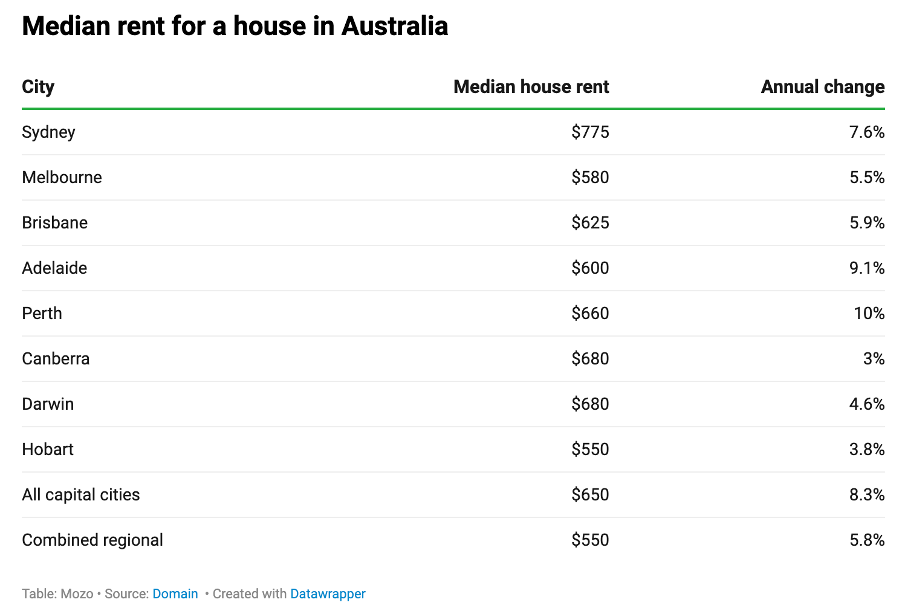

Some rental markets are in their highest yet, with research showing that almost half of renters are spending over 30% of their income on rent. With Sydney and Perth leading the rental price surge due to their tight rental market.

Other considerations- The cost to buy property

When it comes to buying property, there are other costs that need to be factored in.

When we have considered locations where it might be cheaper to buy than rent, we are looking at the typical average mortgage repayments of a location verses the typical median rental costs of that location, and excluding the upfront costs of buying a property as well as the ongoing maintenance costs of property ownership.

Some of these costs that you will need to consider when buying a property include:

Deposit

Typically, lenders require a deposit of 10%–20% of the property's value. If the deposit is less than 20%, Lenders Mortgage Insurance (LMI) may be required.

Lenders Mortgage Insurance (LMI)

LMI is payable on top of your deposit if you are borrowing more than 80% of the property value, and the amount is dependent on the loan value. This insurance protects the lender, not you as the borrower.

Stamp Duty (Transfer Duty)

There may be some government concessions for first home buyers, so check with your state government for any current grants and schemes available.

Loan Establishment & Ongoing Fees

There will be a loan application fee upon set up of your mortgage, as well as ongoing monthly or annual fees for managing the loan account.

Conveyancing & Legal Fees

You will need to hire a property lawyer or conveyancer to review the contracts which comes at a fee, usually between $1,000-$3,000 depending on the complexity of the work involved.

Building & Pest Inspections

This report is vital to check if there are any structural issues or pest problems before you purchase a property.

On-going costs of home ownership

There are various annual, quarterly, monthly maintenance and ongoing costs of home ownership. These include (but are not limited to) home and contents insurance, Council rates, utility costs, strata fees (for apartments), regular maintenance, and renovation costs.